Are you thinking to apply for the UTR number, well there is nothing to freak out as it is not that scary as some believe it to be. In fact many are going to even change their minds when you will tell them about customers and HM revenues. Applying for the UTR number is not that hard and here you will learn how to complete the process. After doing so you will be able to keep track of your correspondence and returns in easy way. Here are the steps you need to pay attention to or visit Quick Rebates to know more.

Analyze your situation

The foremost thing is to know when to apply for the UTR number and your present condition. You must be clear with the thought, do you need it or not. It is important for the people whoreceive incomethrough self-employment. To make it simple, if you are not self-employed and never done self-assessments, then it is okay and you do not need it. In case you have decided to be self-employed, then you must surely apply for it.

Notify HMRC

After assessing your situation you must apply for the number and notify customs commission and revenue about your position. After registering with HMRC you must notify them about your self – employment. After that they are going to guide you and will also ensure you that you are going to get your UTR number. They can lend you help from here.

Applying to the UTR number

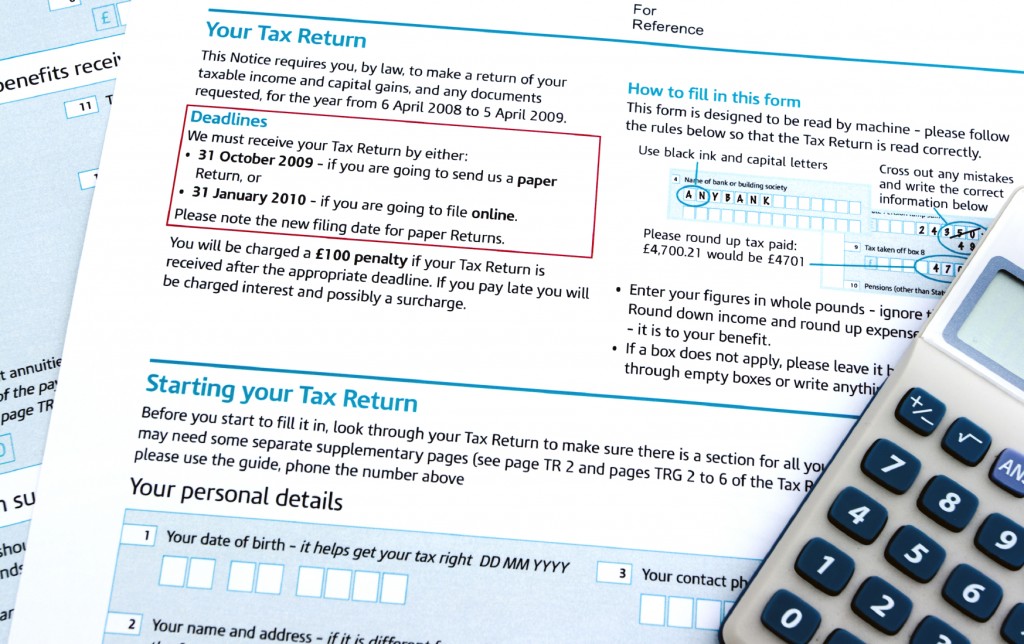

When you give notifications to them of your new status, they will give you a reply that they are working on your application. These days, due to the source of the internet, applying to this number has become easier and faster. You can easily apply to the number by going online. In any case, if you have already applied online, you should know that youshould not anticipate that you are going to obtain your numberthrough your email or any other electronic means. Rather than, you will be able to get it through the post only a few weeks after yourofficial application for the same.

Finding your UTR number on the web

This unique 10 digit number has been issued by the HMRC to you when you have registered for self-employment. it is abbreviated as the unique Taxpayer Reference. This number can be found online in your Government gateway account. When you have applied to the self-employment online, then it is must to set up a web-based account so that the registration process can be managed. At the same time, you can also manage reminders, tax returns and correspondence with HMRC. While registering with the HMRC, you will need to have your government gateway account login as well as the password. By going to the Self-Assessment section, you will be provided with the UTR number. Moreover, the account summary section also has an UTR number on the top right hand side.

So, what are you waiting for? Get help from the QuickRebates to apply now.